State and Explain Different Types of Working Capital

The former is when your companys current assets exceed its current liabilities. Remember negative working capital is a sign of danger and indicates that the company is moving towards the red hence beware.

Read more and therefore working.

. Types of working capital 1. Trade Receivables form a significant part of the current asset Current Asset Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. 5 Key Components of Working Capital.

Different types of capital. Gross Working-Capital- The balance sheet is popularly known as gross working capital for reporting the firms. The different types of funds that are raised by a firm include preference shares equity shares retained earnings long-term loans etc.

Current assets are those assets which are easily. The gross working capital refers to the total fund invested in current assets. The determinants of working capital are items that have a direct impact on the amount invested in current assets and current liabilities.

Tandon committee has referred to this. It is the difference. Reserve Margin Working Capital.

It involves payment of wages financing of overheads raw material purchase etc. The two segments of working capital viz regular or fixed or permanent and variable are financed by the long-term and the short-term sources of funds respectively. The balance sheet view divides working capital into gross working capital and net working capital and the operating cycle view divides the working capital into permanent and temporary working capital.

You can say that the working capital is the number of liquid assets which are using by the company to conduct their business. Different Types of Working Capital Loan. Permanent working capital is divided into seasonal and special.

It is that portion of the working capital that remains permanently tied up in current assets. Second I want to create link in working capital management so that when any student will be interested to know the types of working capital in detail he or she can come here for reading and studying. It can be further divided into two different types of working capital.

Suitable for meeting short term funding requirements in business the loan type comes with a fixed interest rate and has a loan tenor of up to 12 months. This is defined as the least amount of capital required by a business to fund its day-to-day. 1 Net Working Capital.

Types of Working Capital Permanent Working Capital. There are two concepts of working capital. Financial capital which is also referred to as investment capital is the financial assets or economic resources a business or organization needs to provide goods or services and generate future revenue.

Difference between Capital Cash Flow CCF and Adjusted Present Value APV Approaches. Differentiate between capital account and current account. The gross working capital is the amount of a companys total investment in current assets.

Differentiate between capital expenditures and revenue expenditures. It is otherwise called as Fixed Working Capital. There are two concepts of working capital.

For public limited companies that sum was Rs. It has two reason one is explain types of working capital more detail. Net Working Capital is a comprehensive study of the financial condition of a business entity.

So Now I am concentrating on types of working capital. But the period for which temporary working capital is required is rather short and the amount is also fluctuating whereas the amount of permanent working capital is stable and it is permanently needed. Gross Working Capital.

8 Sources of Working Capital Finance Explained. I Gross concept and ii Net concept. Managers like to keep a close watch over these factors since working capital can absorb a large part of the funding that an organization has at its disposal.

There are three different types of share capital categories - Authorised Capital Paid-Up Capital and Subscribed Capital. Under this approach the corepermanent working capital is financed from long-term capital sources and short-term fundingborrowing is used to meet seasonal. Explain Regression analysis method in estimation of working capital.

Working Capital is divided into various types based balance sheet view and operating cycle view. These funds are raised for running the business. Under the Companies Act 2013 any private limited company had to authorise or release a minimum of Rs.

The management has to provide for both kinds of working capitalpermanent working capital and temporary working capital. On the other hand negative net working capital is when the liabilities outdo the assets. Operational Capital Operational Capital has been split into permanent working-capital and temporary working-capital.

It can be further divided into positive net working capital and negative net working capital. 1 Trade Receivables. Working capital should be efficiently used in order to achieve long term growth and profitability.

Or you can say that the total amount of short-term capital needed to run the business operations is called gross working capital. Long-Term Working Capital Loan. Explain operation cycle method in estimation of working.

Types of Working Capital. In such a situation seeking a working capital loan will help you restore balance. It comprises inventory cash cash equivalents marketable securities accounts receivable etc.

Different Types of Working Capital. The main sources of long-term funds are shares debentures term- loans retained earnings etc. It is a part of the permanent working capital that a business requires for its daily operations.

Here is a list of nine different types of capital. The difference between a companys current assets and current liabilities is called working capital. The meaning of Capital structure can be described as the arrangement of capital by using different sources of long term funds which consists of two broad types equity and debt.

1 Lakh as minimum share capital. According to the balance sheet working capital can be classified into. It is otherwise called as Fluctuating or Variable Working Capital.

Permanent or fixed working capital is the minimum amount required to perform normal business operations whereas temporary or seasonal working capital is required to satisfy specific requirements. I Gross Concept of Working Capital. Net Working Capital.

Collection Invoice Flowchart Flow Chart Process Flow Chart Process Flow Diagram

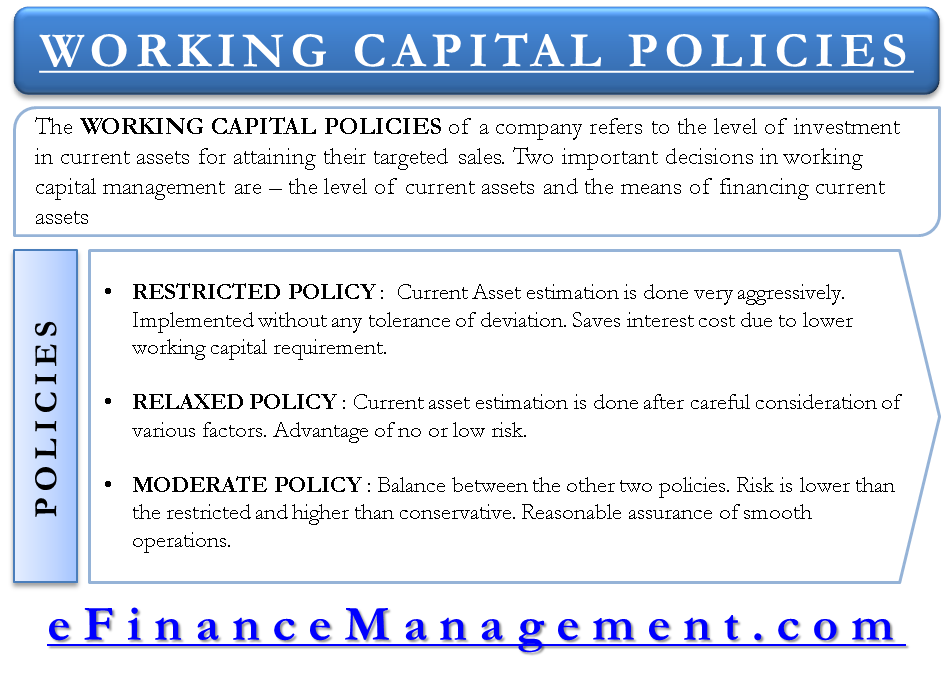

Working Capital Policy Relaxed Restricted And Moderate

Company Registration Formation In Usa Register Company In Delaware Business Planning Startup Business Plan Success Business

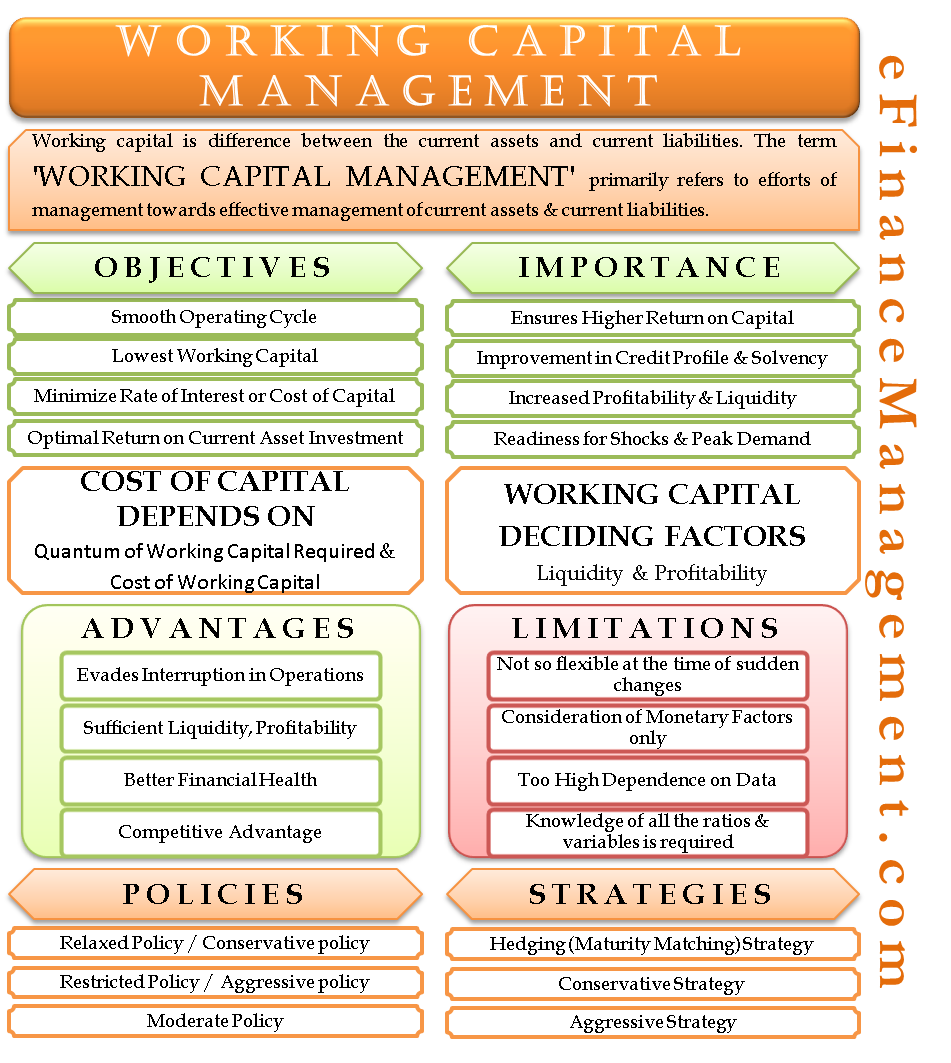

Working Capital Management Meaning Goals Strategies Policies Etc

Organisational Behaviour Why Do People Work Organizational Behavior Job

Image Result For Social Capital Social Capital Social Entrepreneurship Social Digital

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

Prialto Blog Best Practices For Working With A Virtual Assistant Crm Customer Relationship Management Crm Strategy Crm Virtual Assistant Services

Working Capital Types Of Working Capital Learn Accounting Finance Types Of Work

Working Capital For Business Based In Usa Group Work Short Term Loans Business

Investigation Report Templates Report Template Interview Report Investigations

What Is Capital Definition Types And Examples Pareto Labs

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Financial Planning Assignment Help Custom Essay Service Writing Ase Where Can I Buy Paper For Invitations Financial Planning Financial How To Plan

Bridge Loan Meaning Features How It Works Pros And Cons Bridge Loan Money Management Advice Accounting And Finance

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Comments

Post a Comment